First of all, I’m not a financial advisor. I’m merely sharing my views and thoughts on this platform.

Subscribe to this newsfeed on substack to receive categorized updates like this one. Follow me on etoro for real time updates

I like putting my money in a diversified set of well-known brands. This is not always easy when seeking above-market average returns., but it is a strategy I feel comfortable with.

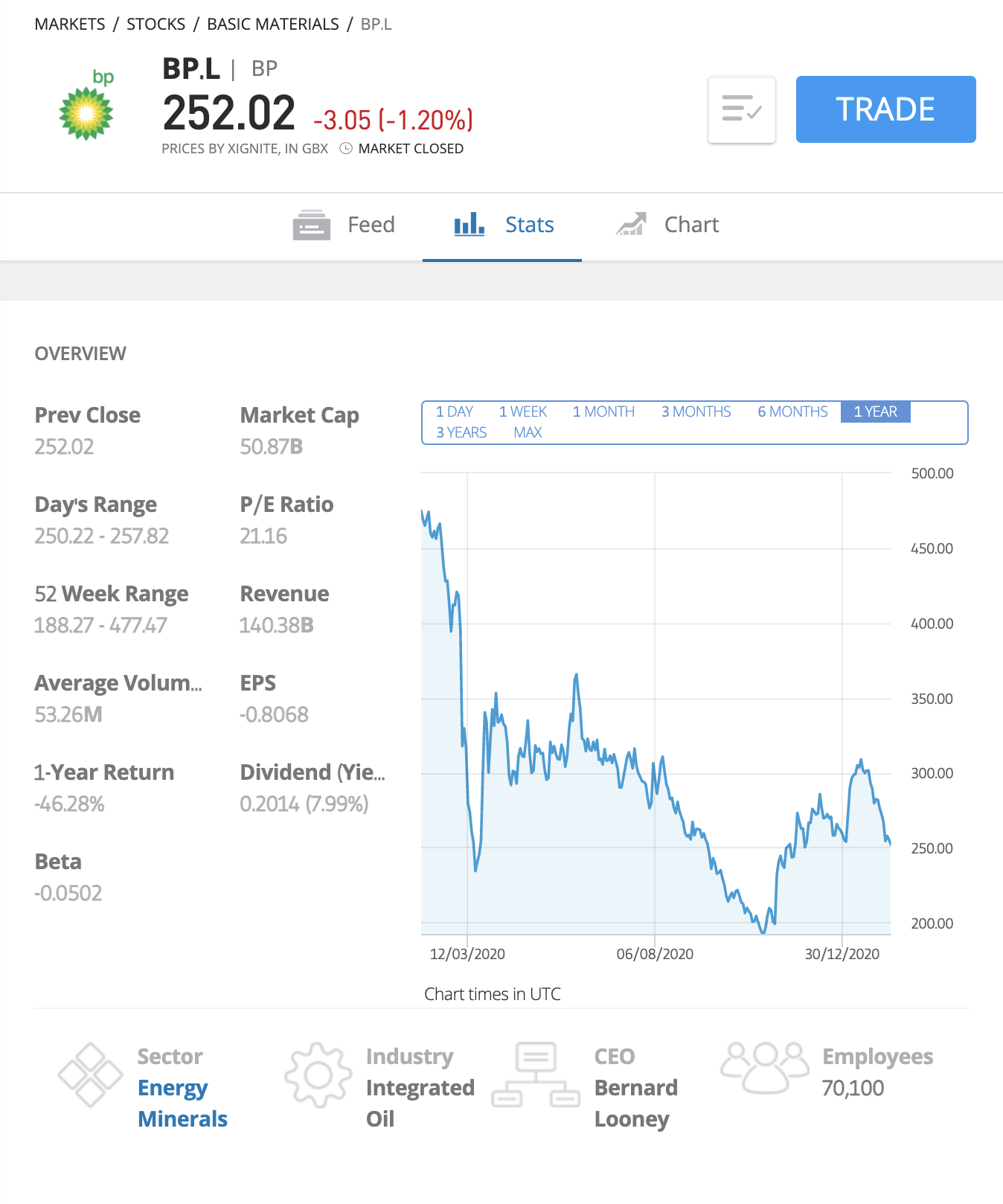

BP is one of those very well known Mondial brands.

I’m not heavily invested in brands like BP or other fossil fuel companies. This, combined with the potential upside during times of COVID recovery made me look into the stock.

COVID Recovery

BP had a rough year. However, analysts say that relative to the industry, $BP is a strong bet. Which makes it a true consideration as a COVID recovery bet.

Clear upside given analyst opinions

This is by far the main factor I take into account in the final moments before I invest in a stock: What do the analysts think.

The weight of the analyst opinion depends on the kind of investment we’re looking at. For example: When you’re investing in $PLTR because you think the stock is misunderstood and therefore undervalued in its long-term potential, you’d expect the median in a chart like the one below to be lower than your vision for the company is.

Source: money.cnn.com

All by all, I’m adding BP to my portfolio to diversify and for their potential COVID recovery upside.

Let me know in the comments what you think about BP and please do share your views!